The biggest brands in the Scottish trade

By Dave Hunter

Total Scottish on-trade drinks sales sat at £2.33 billion in the year to 14th June 2025 – an increase of just £18 million when compared to the previous year.

Although that increase is, in itself, pretty unimpressive – representing below-inflation growth – the devil, once again, is in the detail.

Lager sales, for example, continued to be healthy in Scotland’s pubs and bars, having grown by more than £30m for the second year in a row.

The stout renaissance also continued for a third consecutive year, with sales also growing by almost £30m.

However, both vodka and gin continued to decline – in gin’s case by around £11m, to £129m, and in vodka’s by around £12m, to a value of £217m.

That latter stat is reflected in stout giant Guinness surpassing its Diageo stablemate Smirnoff to become Scotland’s second-biggest drinks brand in value terms.

While other challenger brands continue to chip away at Guinness’s market, it’s clear The Black Stuff is still the undisputed king of the category.

Elsewhere other undisputed kings have also retained their crowns. Tennent’s remains the biggest lager – and biggest brand overall – with Strongbow still the biggest cider and Gordon’s still the biggest gin. However, there’s plenty of changes beneath these big names.

Here is an overview of the biggest-selling alcohol brands in the Scottish on-trade by value, along with some commentary on selected brands and categories.

As in previous years, the data for the Top Brands feature was supplied by CGA and compiled from the company’s OPMS tracker.

For the most part, the listings cover entire brand ‘families’ – ie the whole product range for a particular brand – however, when one product has achieved a particularly high value on its own CGA may list it separately.

1. Tennent’s Lager – C&C Group

There’s not much more to say about Tennent’s Lager at this point.

Over the years the Scottish giant has seen challengers from all over the world come and go while it remains Scotland’s favourite pint by some distance.

The past year wasn’t all about retention, though. Tennent’s also managed to grow its sales by around £14m to £330m.

That means that Glasgow’s very own ‘Big Juicy’ accounts for well over a third of the value of the total lager category in Scotland. Ooft!

2. Guinness – Diageo

2. Guinness – Diageo

Last year Guinness leapfrogged Captain Morgan to third place on the Top Brands list. This year it was the turn of Smirnoff to fall to the Mighty G.

And mighty it is. According to CGA’s figures, Guinness accounts for £123 million of the £131m stout category. And that’s just the core product. Guinness Micro Draught is listed separately.

When it comes to Scottish stout sales, nobody does it better.

3. Smirnoff – Diageo

3. Smirnoff – Diageo

No longer the second-biggest drinks brand in Scottish bars and pubs, but all things are relative. In third place, Smirnoff continues to be an on-trade powerhouse.

In the past year the brand has further expanded its already considerable product range with the introduction of Smirnoff Peach, while the Smirnoff name was kept front and centre through Diageo’s sponsorship of 16 Live Nation events that included Glasgow’s TRANSMT as well as Download, Parklife, Isle of Wight Festival and Reading and Leeds.

4. Captain Morgan – Diageo

Brand extensions have been all the rage in the drinks industry for years, but this year Diageo took Captain Morgan in a totally new direction with the launch of Captain Morgan Muck Pit.

What on earth is a muck pit, you ask? It’s a traditional part of the process for creating Caribbean rums which, though it sounds quite unappetising, actually helps to add flavour. The new Muck Pit product, launched ahead of the summer, is essentially a lightly sparkling RTD made with rum and fruit.

5. Birra Moretti – Heineken UK

This year, Heineken’s Italian giant sought to remind beer fans that sometimes life’s simplest pleasures are the best.

A major new marketing campaign for Birra Moretti, which has retained its fifth place on the Top Brands table, stressed the importance of things like good food, good company and – naturally – good beer.

Given that the brand remains Scotland’s second-favourite lager, it’s a message that seems to carry some weight.

In addition to the core Birra Moretti beer, the range also includes the non-alcoholic Birra Moretti Zero and the unfiltered Birra Moretti Sale di Mare, which is said to contain a hint of Italian sea salt.

6. Gordon’s – Diageo

Retaining its sixth place from 2024, Gordon’s remains the biggest gin brand in Scottish bars and pubs – more than ten places ahead of its nearest rival.

Much like Diageo stablemate Smirnoff, there’s no shortage of choice in the Gordon’s range in 2025; in addition to the long-established London Dry gin, the brand now also covers more recent additions such as Gordon’s Pink, Tropical Passionfruit, Mediterranean Orange and Morello Cherry as well as alcohol-free versions of both the London Dry and Pink variants.

7. Absolut – Pernod Ricard UK

Pernod Ricard never seems to sit still when it comes to the second-biggest vodka brand in the Scottish trade.

This year the company launched the latest phase of its Absolut brand campaign, Born to Mix, which highlighted the ties between cocktails and dance culture. The TV ad for the campaign, directed by music video director Henry Scholfield, featured top dancers bringing various Absolut cocktails to life through dance.

Scotland’s bar staff may be ever so slightly less showy than that, but they’re clearly punting plenty of Sweden’s most famous vodka.

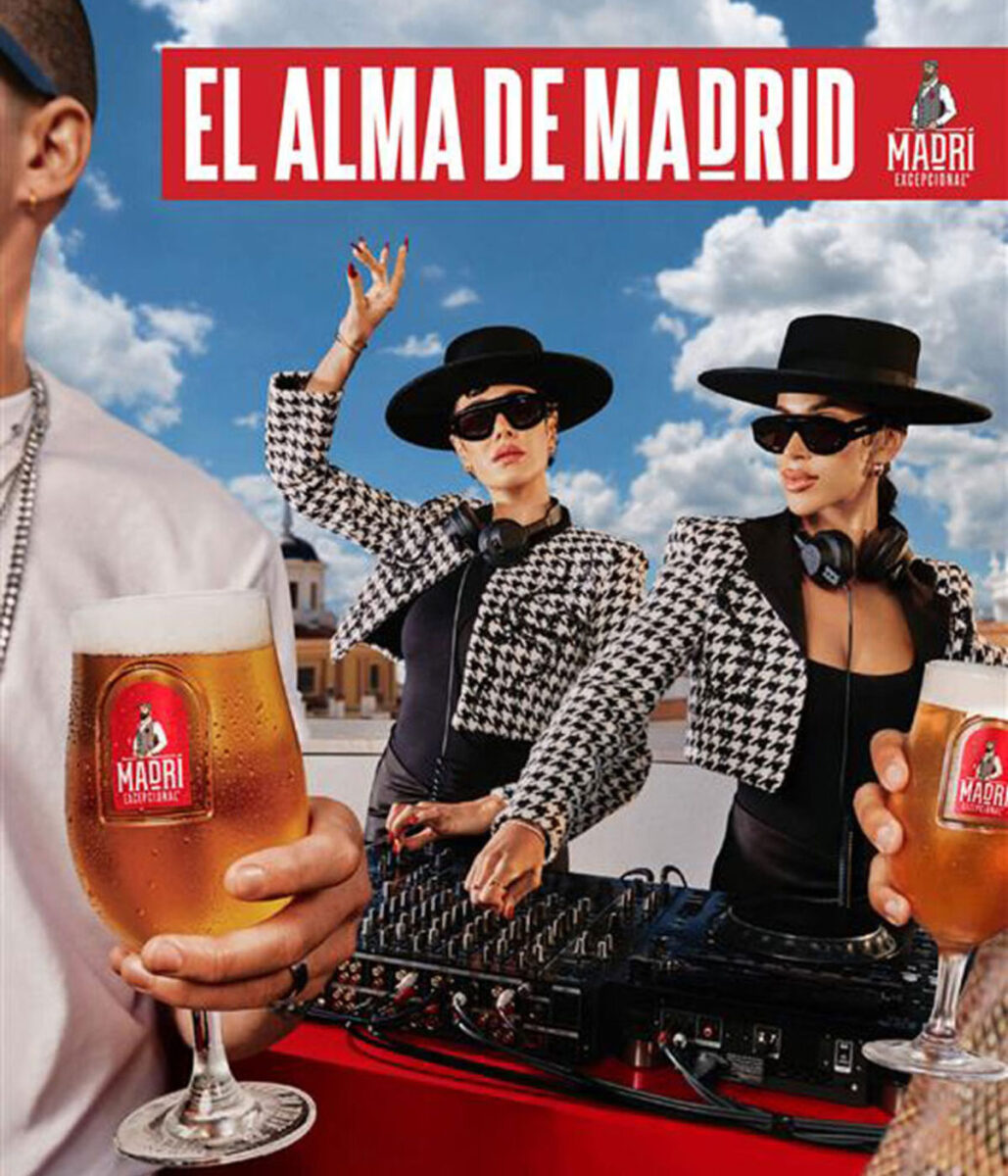

8. Madrí Excepcional – Molson Coors

The rise of Madrí Excepcional continues in 2025 as the Molson Coors-owned brand surpasses Peroni to become the 8th best-selling brand in Scottish hospitality.

It’s a been a busy year for Madrí, with another major summer ad campaign that positioned the brand as ‘El Alma de Madrid’, or ‘the soul of Madrid’. Madrí fans were also given the chance to win tickets to the All Points East music festival in London via a summer competition.

9. Peroni Nastro Azzurro – Asahi UK

The team behind Peroni looked to strengthen ties with the brand’s fans this year with the launch of loyalty scheme Club Peroni.

The programme rewards customers with points when they purchase bottles or pints of Peroni, which they can then redeem for a range of prizes.

The brand also continues to leverage its partnership with the Ferrari Formula 1 team, which it sponsors through its Peroni 0.0 non-alcoholic variant.

10. Jack Daniel’s – Brown-Forman

MOVING up a position from the 2024 list, Jack Daniel’s rekindled its love affair with live music this year, through a partnership with grassroots music organisation Music Venue Trust. The initiative involved the sponsorship of a UK-wide tour for up-and-coming musicians and which took place at grassroots venues around the country.

And last month the brand team had some fun with their founder’s ambiguous birthday.

The ‘Jacktember’ campaign celebrated the fact that no one can now remember Jack Daniel’s birthday – only that it was sometime in September.

11. Famous Grouse – William Grant & Sons

No, that isn’t a typo. Famous Grouse, which has climbed four places on this year’s Top Brands list, is now a William Grant & Sons-owned brand, having been sold by longtime owner Edrington UK late last year. It’s early days for the new owner (William Grant only officially took ownership in July), but it’ll be interesting to see what the family-owned company does with Grouse, which has been the best-selling Scotch whisky in the Scottish on-trade for years.

12. Strongbow – Heineken UK

Strongbow further expanded its product range earlier this year with the introduction of Strongbow Strawberry.

The new product, launched in the off-trade last year, is claimed to be the brand’s first launch into the on-trade in more than a decade.

Heineken said the launch was to further tap into the lucrative flavoured cider market, which it said is worth around £200m in the UK.

Heineken’s long-established Dark Fruit variant is listed separately on the Top Brands list, at number 32.

13. Stella Artois – Budweiser Brewing Group

Stella moved into the non-alcoholic beer category in a big way this year with the launch of Stella Artois 0.0 on draught.

Announcing the launch, parent company Budweiser Brewing Group said that, with comparatively few venues stocking non-alcoholic beers on tap, there is huge potential for a brand like Stella to meet that demand.

14. Baileys – Diageo

Moving up into the top 15 brands for the first time in recent memory, Baileys remains the undisputed boss of the speciality and liqueurs category – more than ten places ahead of the next-biggest brand.

As with other brands on this list, Baileys has expanded its product range through the years to include a number of different variants. Just last month, Baileys joined forces with chocolate brand Terry’s to launch a co-branded Baileys Chocolate Orange flavour in time for Christmas.

15. Corona Extra – Budweiser Brewing Group

Few beer brands can lay claim to a ritual quite as embedded as the ‘slice of lime in the bottle’ that’s associated with Corona.

Corona is more than a pleasant sunshine beer backed up by a fun garnish, though. It was announced earlier this year that the Mexican megabrand is the world’s most valuable beer brand – a title it has now retained for two years in a row. Talk about world famous.

2. Guinness – Diageo

2. Guinness – Diageo 3. Smirnoff – Diageo

3. Smirnoff – Diageo