By Jack Cummins

This month I’m looking at a couple of gaming questions that have arisen in the past few weeks and require more space than usual for a proper response.

The first concerns the use of gaming machines in pubs and other on-licensed premises. Back in the day, the use of so-called ‘AWP’ (amusement-with-prizes) machines depended on the issue of a permit under the Gaming Act 1968.

The application procedure was nothing less than a pain in the neck, particularly since the grant of a permit usually took a very long time.

A reader tells me that he has just taken over a pub and the installation of gaming machines is an early priority.

He believes that a permit is no longer required but is unsure as to the formalities and wonders whether he can simply take over the permission granted to the previous licence holder.

Happily, this is a pretty straightforward exercise. The law is now found in the Gambling Act 2005 which provides for an “automatic entitlement” to the use of machines.

That entitlement is triggered by the giving of notice to the licensing authority of the intention to make available for use two gaming machines of Category C or D. Any notice given by the outgoing licence holder isn’t carried over: the entitlement needs to be renewed where the licence is transferred.

This isn’t an application process. The notice is simply given by letter under reference to Section 282 of the Gambling Act and must be accompanied by the prescribed fee (currently set at £50). The only matter for the licensing authority (the Board) to determine is whether the notice is given by the holder of a “relevant Scottish licence”: that is to say, a premises licence issued under the Licensing (Scotland) Act 2005 other than a licence only authorising the sale of alcohol for consumption off the premises.

As to the available machine types, those in Category C have a maximum stake of £1 and a prize not exceeding £100. They may only be used by players aged 18 or over.

Broadly speaking, Category D machines are low-stake machines such as coin pushers or crane grabs not usually found in pubs. It’s worth adding that skill-with-prizes machines (SWPs) are not treated as gaming machines and don’t count towards the machine allowance I’ve described above.

However, this is a rather complex area and whether a machine falls within the SWP classification depends on a range of factors. It would not be wise to install this type of machine unless absolutely satisfied that it was a genuine skill machine.

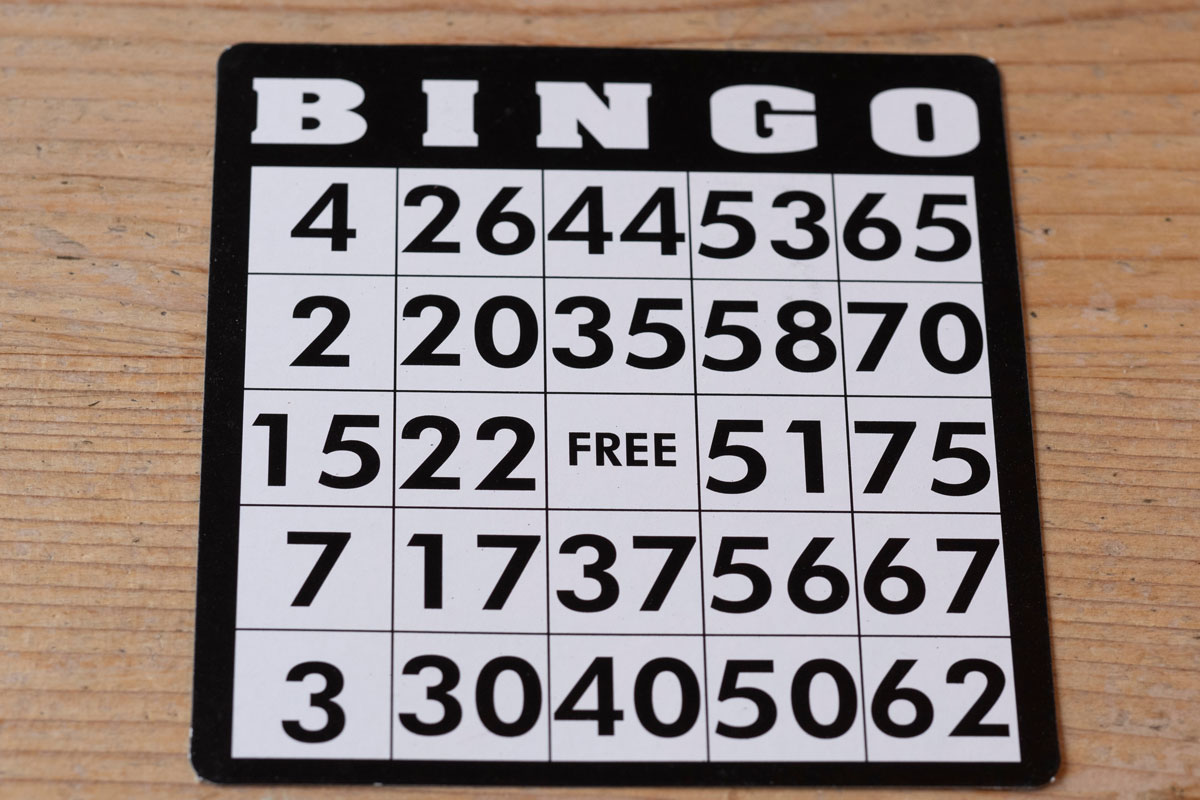

The second question concerns a bingo night in a pub. If the playing of the game is to constitute “exempt gaming” not requiring a licence, a number of conditions must be met. These may be summarised as follows: (a) all players must have an equal chance of winning; (b) no persons under 18 may take part; (c) total stakes and prizes do not exceed £2000 in a seven-day period; (d) the stake limit is £5 per player per game; and (e) all the stakes must be returned in prizes.

There are also several prohibitions.

Games can’t be linked with those taking place on other premises, nor may the bingo be played virtually or online in any fashion. A fee for admission or participation is forbidden, as is the making of any profit (even where the profit would be given over to a charity or good cause).

You can’t deduct from or ‘levy’ on money staked or won by the participants, even if the charge is described as ‘voluntary’.

It follows that if a game of bingo is being staged as part of a wider event taking place on premises and that event has an admission charge, then those taking part in bingo must be allowed free entry for participation in the bingo (subject of course to paying a stake not exceeding the £5 maximum).

As you’ll gather this is a rather complicated area and if you are in the slightest doubt as to whether your bingo night would comply with the law, it is essential to take expert advice.

Also, it’s important to keep in mind that any gaming activities must be authorised in your premises licence operating plan.

Q & A with Jack Cummins

Q: My hotel has two dining areas: a formal ‘fine dining’ restaurant and a bistro-type operation. The former isn’t generating enough revenue and I want to convert it to a function space, which we presently lack. Is that going to be a straightforward exercise?

A: That will require an application for a non-minor (‘major’) variation to your premises licence to introduce the new ‘activity’ in the operating plan and alter the layout plan. The change will also impact on the hotel’s on-sales capacity. Depending on where the property is located, that change can cause a headache because of building control considerations in relation to the provision of sanitary accommodation. Plus, other parts of the operating plan will require various adjustments – in all likelihood, access by under 18s for example – so it would be as well to get a solicitor involved.

Q: I operate an online gift hamper business including alcohol products and find myself in a dispute with a customer insisting on a refund. She ordered a hamper including some bottles of wine with personalised labels. I’ve told her that I can refund the cost of the other items but am not obliged to give a refund on the wine. Is that a legally sound position?

A: In my view, that is the correct approach. The governing legislation is found in the Consumer Contracts (Information, Cancellation and Additional Charges) Regulations 2013. Generally, purchasers of goods from an online business are entitled to a 14-day refund window (starting on the day after delivery).

Unless other provision is made, the purchaser is responsible for the cost of the return. However, ‘bespoke’ or personalised goods are an exception and the wines fall within that category. (I’m assuming that you made the returns policy clear on your website.) Once the returnable items have been sent back you have 14 days to issue the partial refund.