Pub giant JD Wetherspoon has revealed full year results showing a near 74% increase in profits – a positive financial performance that prompted the restoration of dividend payments to its shareholders, ending the four-year suspension in place since the outset of the Covid lockdowns.

Pub giant JD Wetherspoon has revealed full year results showing a near 74% increase in profits – a positive financial performance that prompted the restoration of dividend payments to its shareholders, ending the four-year suspension in place since the outset of the Covid lockdowns.

That shareholder dividend has been brought back at the rate of 12p per share, the same as it was just before the pandemic. Similarly, Wetherspoon’s results and balance sheet now look broadly the same as they did in pre-pandemic 2019.

In its venues, sales rose by 7.6% across the last financial year, with total revenue up 5.7%, producing a profit before tax increase of 73.5%.

There has also been as ‘solid start’ to the new financial year, with like-for-like sales rising 4.9% in its first nine weeks.

On the financial markets, pundits are reporting that pub groups which suffered under the pandemic and the cost-of-living crisis are now recovering, as inflation and interest rates ease, and customers’ spending power returns.

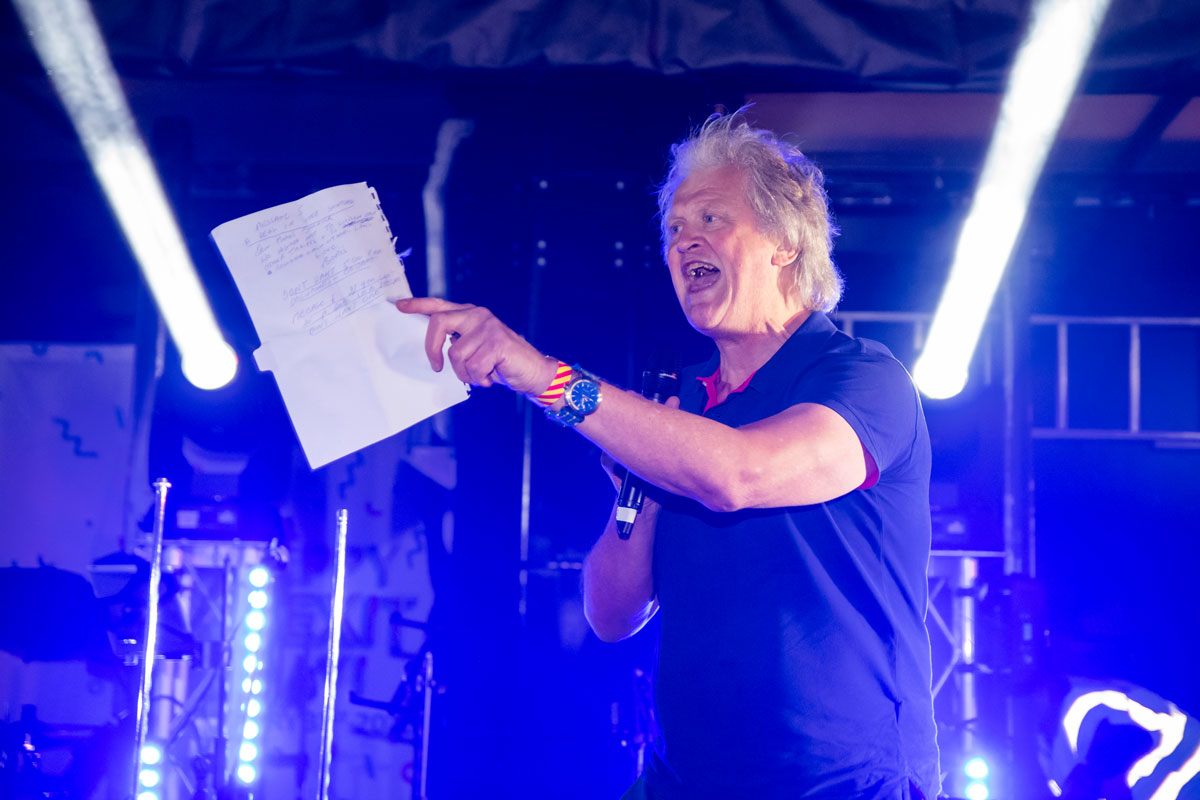

JD Wetherspoon chairman Tim Martin is on record as saying that his business wasn’t unduly affected by Britain’s unseasonably wet summer, but the August riots put a dent in its performance.

Shares in the FTSE 100-listed company, which had fallen about 10% over the course of this year, have rallied since these latest results were published, and were sitting around 726 pence per share at time of publishing.

Speaking from investment brokers Wealth Club, portfolio manager Charlie Huggins commented: “Wetherspoons has enjoyed a good year, reporting a significant recovery in sales and profits and a return to the dividend register. With many pub and restaurant companies struggling in the current environment, this is an impressive performance.

“In an environment where the strong seem likely to get stronger, Wetherspoons looks well placed to grow market share and sustain its recent sales momentum,” he predicted.